Blog

Welcome to the Hooper & Co blog

By Hooper & Co

•

04 Apr, 2020

On Sunday Christian Porter, the Federal Attorney General, gave a commitment to Australian businesses that "the JobKeeper Payment legislation would pass parliament on Wednesday, no matter how late the parliament needs to sit to get the bill passed".

By Hooper & Co

•

03 Apr, 2020

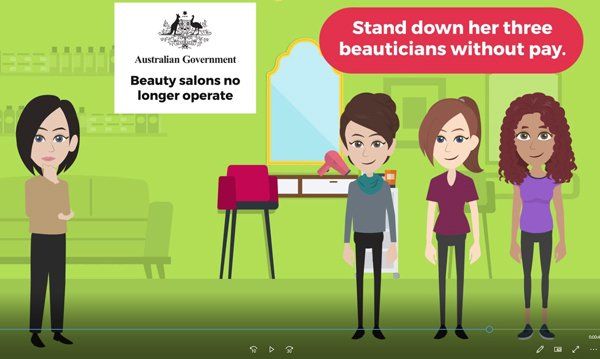

State governments have announced a series of measures in to help small and medium sized businesses stay solvent and to keep their staff employed, during the COVID-19 economic downturn.

By Jonathan Hooper

•

26 Jun, 2016

We hope the site provides you some useful information about us and the services we offer.

We would like to extend a big thank you to the Wolters Kluwer team in Christchurch New Zealand for their untiring and professional work in developing the site.

In particular, a big thank you to Stacey Cooper who has provided great patience, support and guidance.

Another big thanks to Dr. Gusius Gus who took the time away an enormously busy schedule to assist with the marketing and design of our accounting practice, your efforts are much appreciated.

Finally, a massive thank you to all our valued clients and staff. Without your continued support the success of this practice would not be possible.

Get in Touch

Phone

Copyright Hooper & Co Chartered Accountants ©

| Disclaimer

| Email Policy

| Sitemap

| Websites for accountants by Wolters Kluwer

Liability limited by a scheme approved under Professional Standards Legislation